Preapproval Comes First in Silicon Valley Home Buying

In Silicon Valley real estate, speed and clarity matter. One of the smartest moves a buyer can make is getting preapproved before touring homes, not after falling in love with one.

Preapproval is not a guess. It is a lender reviewing your income, assets, credit, debts, and savings to determine what you can realistically borrow. Think of it as grounding your home search in facts, not hope.

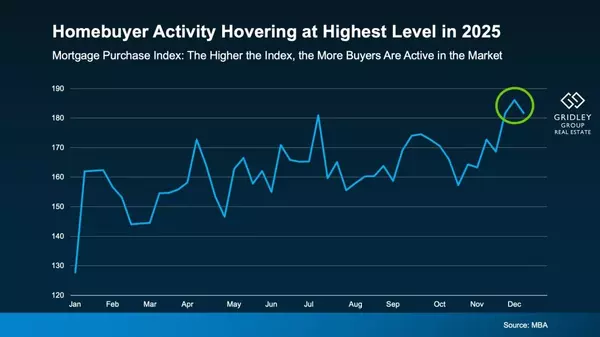

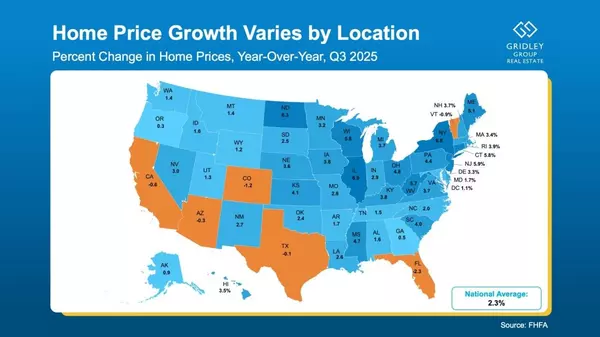

Right now, the Silicon Valley market is more balanced than it has been in recent years. Mortgage rates move. Inventory shifts week to week. Well-priced homes still attract attention quickly. Preapproval gives you clarity on your budget, confidence when writing an offer, and control if the right opportunity shows up unexpectedly.

For buyers, it prevents wasted time and emotional whiplash. You know what fits and what does not. For sellers, a preapproved buyer signals seriousness and readiness. It tells them the financial work is already done.

Many buyers worry that preapproval means pressure to buy immediately. It does not. Most preapprovals last sixty to ninety days and can be refreshed. It simply keeps you prepared.

A good question to ask yourself is this. If the right Silicon Valley home came on the market today, would you be ready to act?

If the answer is not quite, preapproval is the logical next step. It does not lock you in. It opens doors.

Recent Posts

Her expert knowledge, negotiation, and marketing skills combined with her high level of commitment provide a framework for lasting relationships. Lynsie commits to “Bringing you the Best!”