Preparing for a 2026 Home Purchase in Silicon Valley Starts Earlier Than You Think

More buyers are quietly getting ready for 2026, and the ones who will feel the most confident next year are not the ones rushing. They are the ones preparing now.

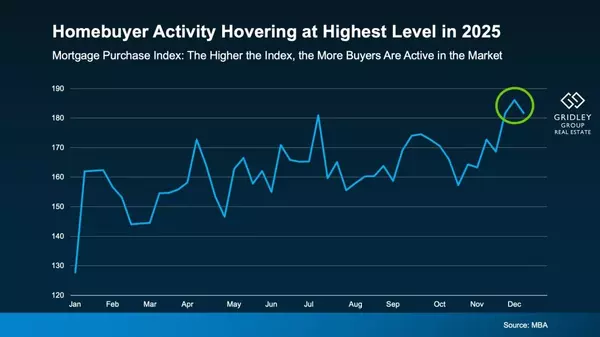

Recent surveys show buyer interest is rising again after several slower years. That does not mean the market is suddenly easy, especially in Silicon Valley. What it does mean is momentum is returning, and preparation is becoming the difference between stress and confidence.

Why early preparation matters in Silicon Valley

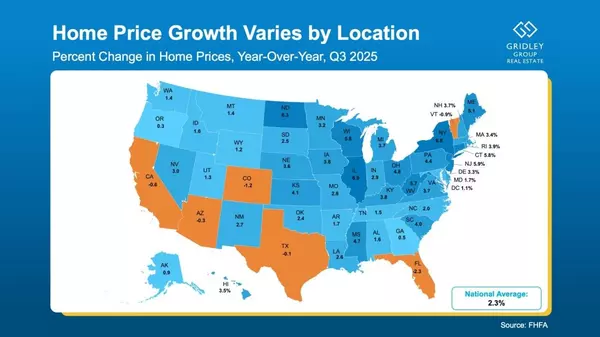

Silicon Valley is a market where small details matter. Pricing varies block by block. Competition can turn on quickly. Buyers who wait until they feel urgency often feel behind.

Preparing early does not lock you into buying. It gives you clarity. It allows you to understand what is realistic, what trade-offs may be required, and where flexibility exists.

When more buyers reenter the market, the ones who succeed are usually the ones who already know their numbers and priorities.

Understanding your financial picture

You do not need a preapproval a year in advance, but you do need awareness. Reviewing your monthly expenses, debt, and savings helps you define a comfortable payment range.

In Silicon Valley, that clarity matters even more. Knowing what feels sustainable allows you to filter homes confidently and avoid emotional decisions later.

As you get closer to shopping, a lender can help formalize your buying power. Until then, awareness is the goal.

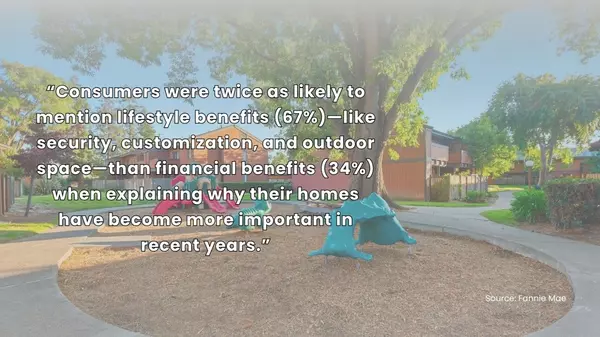

Defining what really matters

Many buyers struggle not because there are no homes, but because they have not clarified their non-negotiables.

Location, commute, school options, layout, and lifestyle needs should be clear before touring homes. Cosmetic features can change. Core needs cannot.

Buyers who do this work early move faster and with less regret later.

Choosing your agent before you need one

One of the most overlooked preparation steps is choosing an agent early. A strong local agent does more than open doors.

They help you understand neighborhood pricing trends, competition levels, and timing strategies specific to Silicon Valley. They also help you prepare emotionally for how fast decisions may need to happen once you are active.

That relationship does not need to start with showings. It can start with conversations.

Low-pressure ways to prepare

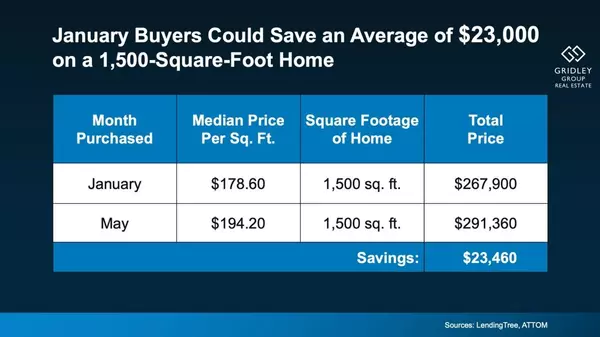

Preparation does not require drastic changes. Simple actions add up.

Improving credit can improve loan terms. Automating savings builds consistency. Using bonuses, tax refunds, or side income to grow your home fund creates momentum without stress.

These steps quietly strengthen your position over time.

Looking ahead to 2026

As buyer demand increases, preparation becomes leverage. Buyers who have done the work feel calmer and more in control. They can recognize the right opportunity when it appears.

Final thoughts

If buying a home in Silicon Valley is part of your 2026 plan, the best time to prepare is before you feel pressure to act.

If you want help building a preparation plan that fits your timeline and lifestyle, reach out. I am happy to help you think it through clearly and confidently.

Recent Posts

Her expert knowledge, negotiation, and marketing skills combined with her high level of commitment provide a framework for lasting relationships. Lynsie commits to “Bringing you the Best!”